The most important considerations in deciding when to sell your home are your family’s goals, lifestyle choices, and wealth planning. The seven points outlined below should be evaluated with a holistic approach, taking into account your individual circumstances.

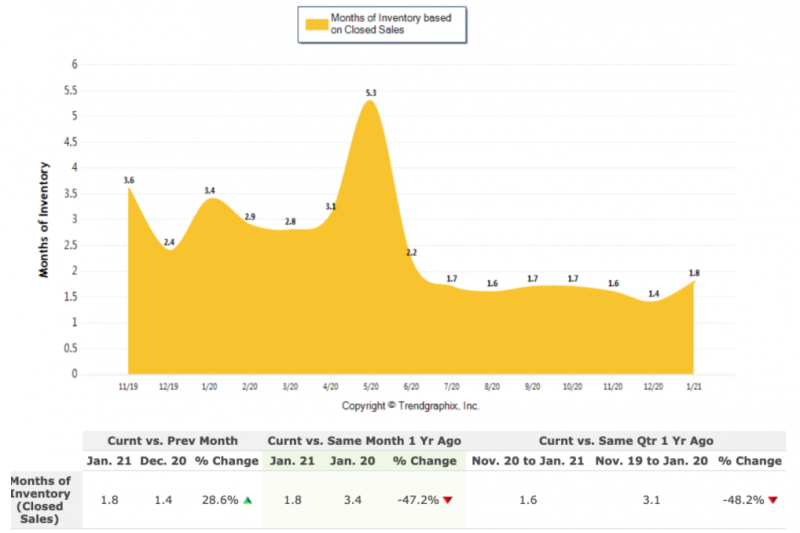

Inventory Shortage:

Right now (February 2021) we are in a market with 1.8 months of inventory. Last year we had 3.4 months of inventory – this is a decline of 47 percent. Even in hot markets, we generally measure the supply of housing in months’ supply (a supply of five months’ or fewer is considered a seller’s market) In many segments of our market today, we are measuring supply in days’ or weeks’ supply, not months’. In some market segments, it is common to see average days on the market of 3 weeks or less.

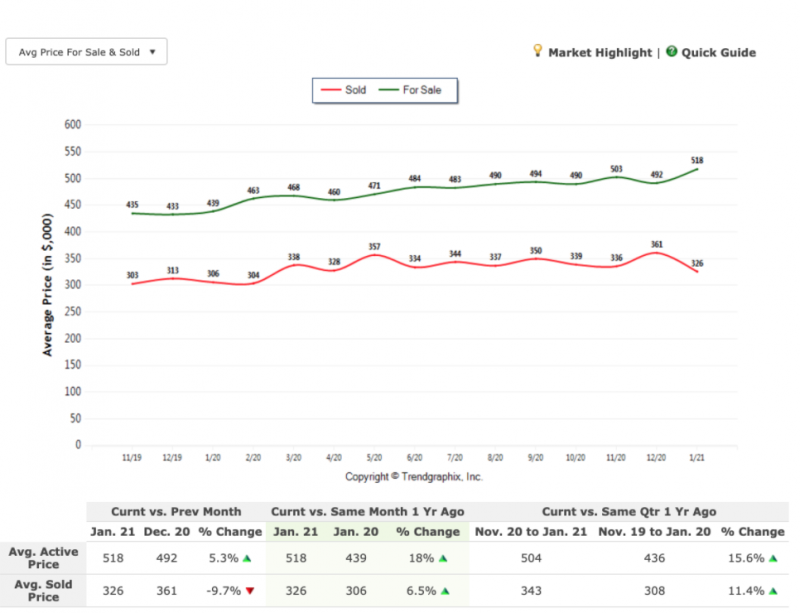

Upward Pressure on Prices:

We all remember Economics 101, the simple law of supply and demand. Inventory shortages mean we generally expect home prices to continue to rise during the first half of the year, and possibly throughout 2021.

The current list price of a home in the Ann Arbor MLS is 18% higher than one year ago and the average sold price of a home rose 6.5% vs. one year ago. It really can’t get much higher than this. Inventory is squeezed so low and prices so high, that there isn’t much more room to grow before so many buyers are pushed out of the market that prices will have to start going back down.

Serious Buyers:

Good homes in high-demand areas often attract multiple offers. In today’s market sellers are able to set the terms of their sale. Extended closings, leasebacks, and contingencies on securing your next home are common concessions offered by buyers to win the sale in multiple offer situations.

Buyers are coming into the market ready to compete and are doing what it takes to get into a home they want giving sellers the flexibility they need to make their move.

Spike in Buyer Activity:

Buyer demand is driven by record-low interest rates, demographic trends (Millennials are in their peak buying years and Baby Boomers need to downsize.) Also the “COVID effect” – buyers are anxious to get the spaces they need for home offices, more at-home children activities, exercise, and recreation spaces. Homebuyers are looking for privacy and security. Renters and families searching for more space are also driving this type of demand. If they weren’t sure about moving before, they are now.

Record Low-Interest Rates:

Interest rates as low as 2% on 15yr loans are possible now. This has shored up affordability, even as prices have increased. Changes in economic policy or inflation pressures could cause interest rates to rise, putting a drag on the market. They can’t get much lower than they are right now!

If you’re not currently in your forever home, this is a great opportunity to lock in a record low-interest rate loan. If rates rise, watch for a spike in buying as the fear of missing out will drive buyers to action. For good reason too! A one percent rise in interest rate translates into roughly a 10 percent increase in a buyer’s principle and Interest payment!

Strong Negotiating Positions For sellers

All of the factors mentioned above are creating a market where sellers have control. Buyers must come with the best offers and very few demands or sellers will simply choose someone else. Buyers don’t have a lot of room to ask for much in terms of repairs, closing credits, warranties, or occupancy deadlines.

Sellers, on the other hand, have a lot of leeway to negotiate beneficial closing conditions for themselves including occupancy after closing, which is what will give you time to secure and close on a new home as a buyer in this hot market.

A window of Opportunity:

When markets shift, they often do so rapidly. As we went into 2008, no one was expecting the financial crisis that we now refer to as the Great Recession. The window of opportunity is wide open for those with the right circumstances to leverage all the factors we’ve outlined here.

If you are trying to “time the market” with your sale: the market truly can’t get much better than it is right now. Inventory is so low and buyer demand is so high, that prices are soaring. As new-construction catches up, interest rates rise, buyers get pushed out of the market, and the economy begins to slow down home prices will have to go back down as well.

At the end of the day, you have to make your choice based on more than just. If this isn’t the right time to move, or you love the house you’re in then it isn’t good to jump the gun on a whim because of the market. If you’ve been planning a move, however, and have been waiting for the best market, you may want to consider if it’s time to act now!

If you’re considering selling your home and would like to discuss the market or receive a free home valuation for your property, contact me, and let’s examine how these forces impact your individual situation. I’m available each week to meet virtually or in-person!