According to Moody Analytics Chief Economist, Mark Zandi, the housing market will likely cool off later this year, though this isn’t a reason to be too alarmed.

Sales of homes in May 2020 were up 13% year over year, but Zandi predicts that this growth will weaken as the government aid used to prop up the economy during the shutdown begins to expire.

“The confluence of high unemployment and the end of the forbearance measures means that we’ll get more defaults and ultimately more foreclosures, more foreclosure sales, and that’ll put some weakness into the housing market”

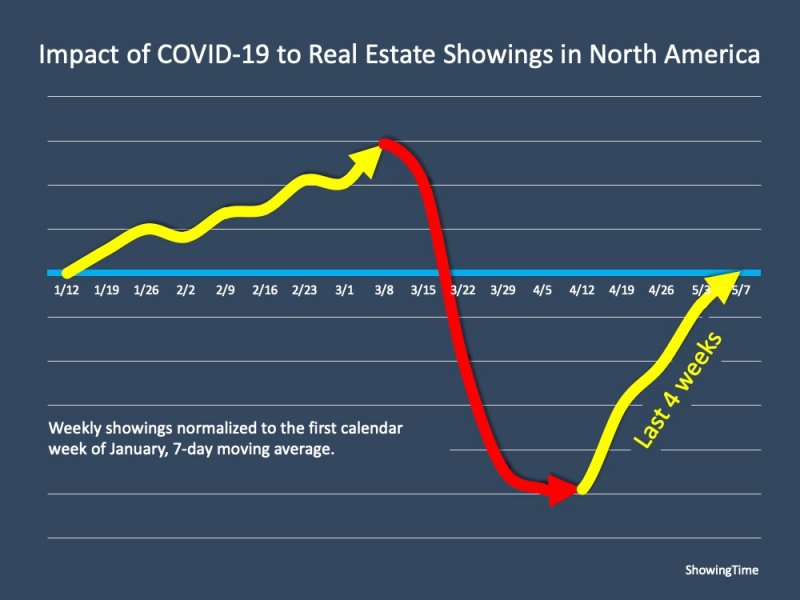

Other experts are noting that the significant growth we’ve seen since the economy has opened back up is likely due to a backlog of buyers and sellers all hitting the market at once.

Ralph McLaughlin, Chief Economist at Haus, explained in their June 2020 Hausing Market Forecast why there is this concern:

“The upswing that we’ll see this summer is a result of pent-up demand from homebuyers and supply-in-progress from homebuilders that has simply been pushed off a few months. However, after this pent-up demand goes away, the true economic scarring due to the pandemic will begin to affect the housing market as the tide of pent-up demand goes out.”

Zandi is quick to note, however, that this is not a reason to panic, saying the housing market has “navigated the pandemic remarkably well, and there are some very solid underpinnings. It’s just going to cool off a bit later this year.”

Overall, the market is strong, mortgage interest rates are still at an all-time low, and we predict this to remain so throughout the year.

There is no reason to be alarmed by a cool down as we breeze through the rest of summer, it is simply a fact to keep in mind especially if you are considering listing your home before this fall!

source: https://haus.com/resources/june-2020-hausing-market-forecast