June is National Homeownership Month, and it’s a great time to reflect on the benefits of owning your own home! Today, 65.3% of Americans are able to call their homes their own, a rate that has risen to its highest point in 8 years!

More than ever, our homes have become an integral part of our lives. Today they are much more than the houses we live in. They’re evolving into our workplaces, schools for our children, and safe havens that provide shelter, stability, and protection for our families through the evolving health crisis.

While some benefits of homeownership are widely known, and a little obvious, there are some hidden reasons that may help you make an informed decision to take the leap into homeownership!

Non-Financial Benefits

- Pride of Ownership: It feels good to have a place that’s truly your own, especially since you can customize it to your liking. According to a publication by the National Association of Realtors (NAR) “The personal satisfaction and sense of accomplishment achieved through homeownership can enhance psychological health, happiness, and well-being for homeowners and those around them.”

- Civic Participation: Your home is your stake in the community, and a way to give back by driving value into your neighborhood. Homeownership can create stability, a sense of community, and increases civic engagement. It’s a way to add to the strength of your local area.

- Establishing roots: Bouncing from rental to rental can become tiresome. If you feel you are in a place to stay, homeownership is a great way to put down roots, become a member of a neighborhood, and connect with those who live and work around you on a deeper level.

- Self Expression: Take your desires and hobbies to the deepest level: Have a menagerie of pets, build out a chef’s kitchen, or auto shop in your garage, Paint the walls purple – there is no landlord to tell you what you can and cannot do. Have the freedom to do what you want in your own space. The personal satisfaction and sense of accomplishment achieved through homeownership can enhance psychological health, happiness, and well-being for homeowners and those around them.

Financial Benefits

Buying a home is also an investment in your family’s financial future.

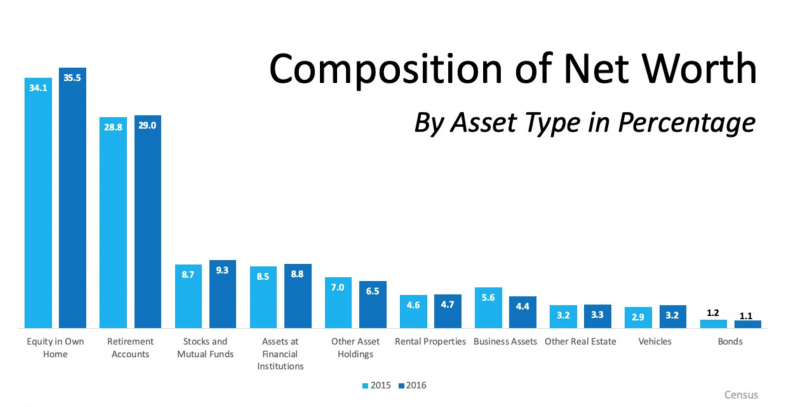

- Net Worth: Homeownership builds your family’s net worth. According to the U.S Census Bureau, as evidenced in the graph above, homeownership can be a key factor in increasing your family’s net worth. Economist Jonathan Eggleston and Survey Statistician Donald Hays, both of the US Census Bureau, remind us that “Net worth is an important indicator of economic well-being”. The median family net worth for all homeowners ($231,400) increased by nearly 15% since 2013, while net worth ($5,000) actually declined by approximately 9% since 2013 for renter families.

- Forced Savings: Each month a portion of your mortgage goes towards principle and this increases each month over the course of the loan. Of course, renters are free to save too. However, many of us may not have the discipline to put away money each month. Your home works like a piggy bank. Want to accumulate equity faster? Take out a 15-year mortgage instead of a 30-year.

- Financial Security: Equity, appreciation, and predictable monthly housing expenses are huge financial benefits of homeownership. Having equity in your home can help your family move in that direction, building toward substantial financial growth. The Harvard University Joint Center for Housing Studies confirms this. One of their studies showed that homeowners acquire 46 times as much net wealth as renters. “For every $1,000 accumulated by non-homeowners, those who own a home acquire $46,000.” Almost 60 percent of the wealth of homeowners is in the form of home equity!

- Tax Benefits: Mortgage interest and certain closing costs are generally tax-deductible (check with a pro about your individual situation). You get most of this relief during those early years when you’re paying the bulk of your mortgage interest. Mortgage insurance and property taxes may also be deductible. That applies to your federal taxes, and many states allow similar deductions. Then when you sell your property, you can take up to $250,000 in profit, tax-free ($500,000 for couples filing jointly).

Economic Benefits

Homeownership is even a local economic driver.

- Housing-Related Spending: An economic force throughout our nation, housing-related expenses accounted for more than one-sixth of the country’s economic activity over the past three decades.

- GDP Growth: Homeownership also helps drive GDP growth as the country aims to make an economic rebound. According to NAR “Every 10% increase in total housing market wealth would translate to approximately $147 billion in additional consumer spending, or 0.8% of GDP, as well as billions of dollars in new federal tax revenue.”

- Economic Recovery: During the COVID-19 crisis, real estate has been a driving force in maintaining some level of stability in the economy. According to a recent study conducted by NAR the average new home sale has a total economic impact of $88,416. By continuing to go out and buy and sell homes, Americans directly impact the health of their local economy which has a “trickle-up” effect that benefits the nation’s economy as a whole.

The bottom line is that the benefits of homeownership go well beyond the surface level! Homeownership is truly a way to build financial freedom, find greater satisfaction and happiness, and make a substantial impact on your local economy.

If you are considering purchasing a home and want to talk about the home buying process, contact us!

For other homeownership related information check out our other articles:

Replacing Your Home Ownership Fears With Facts

Overcoming The Barriers To Homeownership

5 Steps To Buying Your First Home

Does It Make More Sense To Buy Or Rent

The Top Ten Reasons People Buy And Sell Homes