Piper Partners

912 N Main

Ann Arbor, Michigan 48103

Email: andy@piperpartners.com

Find or sell your home today!

(734) 822-7496No matter your experience with real estate, selling a house can be made easier by reading these articles. From the beginning to the end of the process, we can help you put your best foot forward!

The first step of selling any house is choosing a good listing agent. Then, you’ll be ready to evaluate the market and the value of your house. Learn more about how to improve the value of your house here, and about the benefits of staging, repairs, and updates.

Once your home is ready and listed on the market, learn more about when to expect offers, and how to evaluate offers. We also have articles about what to expect during negotiations and the potentially difficult “due diligence” period. Finally, learn what to expect on closing day, and how to get a home sold fast!

Contact us today for a no-obligation house selling consultation. Get a free estimated value report of your home here!

As a first time homebu...

Read More »

What An Agent Does F...

Read More »

If you are shopping ...

Read More »

As we transition into 2025, the housing market continues to grapple with challenges that have persisted throughout 2024. Fannie Mae's Economic and Strategic Research (ESR) Group provides insights into the anticipated trends for the coming year, highlighting factors expected to shape the real estate landscape. This article provides highlights from the Fannie Mae 2025 Housing Outlook with a look at key trends in home prices, mortgage rates and sales. Read the complete report: Fanie Mae's 5 Housing Market Predictions for 2025 for more details; loaded with economic, housing and mortgage information. 8 Steps to buying a home in Michigan in 2025 Download the Piperpartners Real Estate Team 2025 Home Byer's Guide 1. Mortgage Rates: Modest Decline with Continued Volatility The ESR Group forecasts that average mortgage rates will remain above 6% in 2025. Persistent inflation and a stabilizing job market have tempered expectations for significant interest rate reductions. Unless there is a marked slowdown in economic growth, mortgage rates are projected to decrease slightly, approaching 6% by the end of 2025. However, factors such as economic resilience, inflation persistence, and potential policy changes may contribute to fluctuations in mortgage rates throughout the year. 2. Existing Home Sales: Modest Improvement Yet Historically Low Existing home sales are expected to total 4.25 million in 2025, reflecting a 4.8% increase from the estimated 4.06 million in 2024. Despite this improvement, sales remain approximately 20.3% lower than in 2019. The limited recovery is attributed to ongoing affordability challenges and the "lock-in effect," where homeowners with low mortgage rates are disinclined to sell and re-enter the market at higher current rates. 3. New Home Sales: Regional Variations Influence Growth The new home market is anticipated to be a bright spot, particularly in regions conducive to construction, such as the Sun Belt and Mountain West. Of the approximately 750,000 single-family housing permits issued year-to-date through October 2024, 20% were concentrated in metropolitan areas like Houston, Dallas, Phoenix, Atlanta, and Charlotte. This trend is expected to continue, with significant homebuilding activity in these regions throughout 2025. 4. Home Price Growth: Deceleration Expected National home price growth is projected to decelerate, with an estimated year-over-year increase of 3.6% in 2025, down from 5.8% in 2024, as measured by the Fannie Mae Home Price Index. While mortgage rates will continue to pose affordability challenges, the slowing of home price appreciation may allow nominal wage growth to surpass home price growth for the first time since 2011, gradually improving homebuyer affordability conditions. 5. Multifamily Housing: Stability Amidst Challenges The multifamily housing sector is expected to remain stable in 2025, mirroring trends from 2024. Long-term demographic factors support multifamily construction; however, below-average rent growth is anticipated in the near term due to the completion of additional units. Rent growth is projected to be between 2% and 2.5% in 2025, providing some relief to renters and contributing to a gradual improvement in affordability. In summary, while certain segments of the housing market may experience modest improvements in 2025, overarching challenges such as affordability constraints and limited inventory are likely to persist. Stakeholders should remain informed and adaptable as the market continues to evolve.

Ann Arbor Real Estate Marke...

Read More »

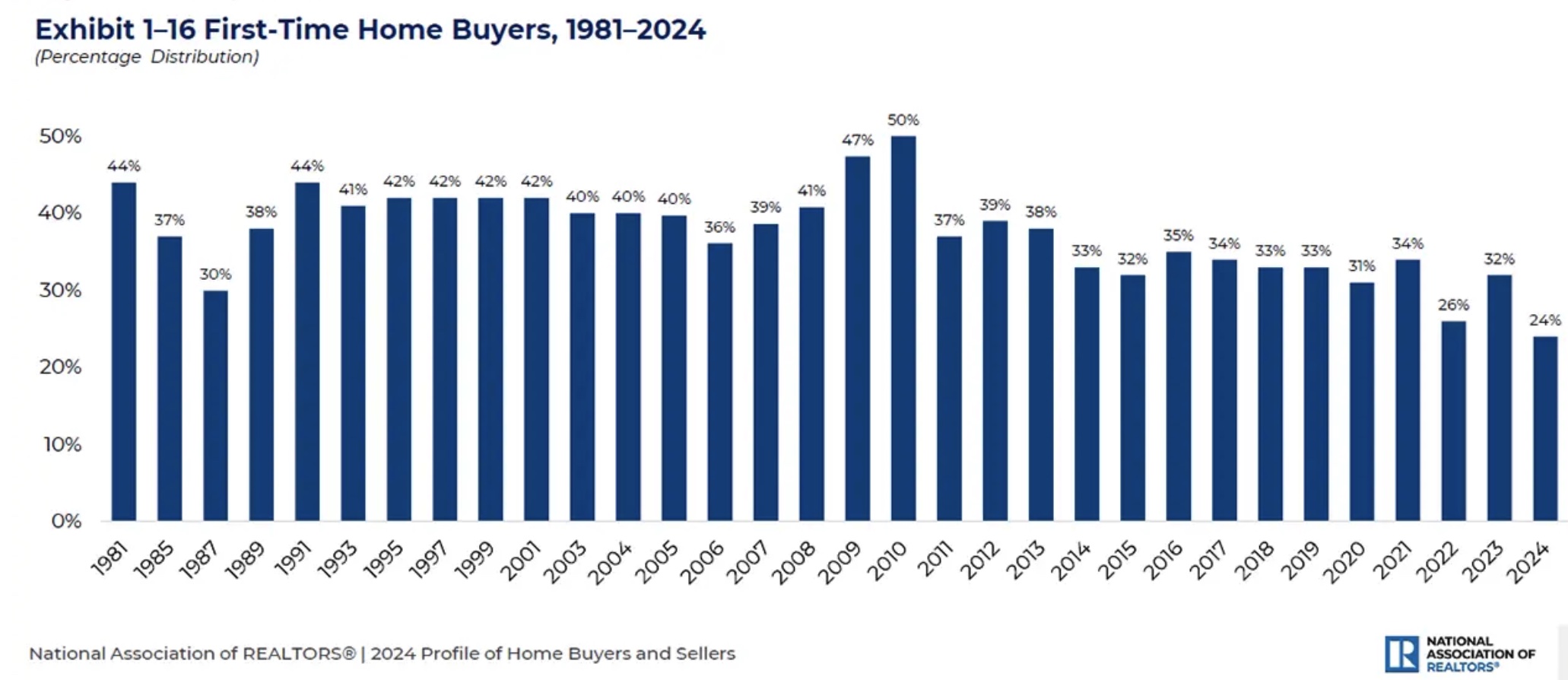

2024 NAR Report: Key Real Estate Market Trends for 2025! Learn what to expect and how to prepare with strategies for buyers and sellers navigating a shifting market. The National Association of REALTORS® (NAR) 2024 Profile of Home Buyers and Sellers offers a comprehensive look at the evolving housing market. From the rise of multigenerational living to the growing role of technology in home searches, the report highlights significant shifts impacting buyers and sellers. Understanding these trends is critical for navigating a competitive and dynamic real estate landscape in 2025. Read highlights of the report here Key Real Estate Market Trends A declining number of First-Time Home Buyers First-time buyers now make up 24% of the market, the lowest share since tracking began in 1981. The number peaked in 2010. Rising home prices, limited inventory, and higher mortgage rates have made it increasingly difficult for younger buyers to enter the market. Many are burdened by inflation, stagnant wage growth, and student debt, which delay their ability to save for down payments or qualify for favorable mortgage terms. Aging Buyer Demographics The average age of first-time buyers has risen to 38, up from 35 last year, while repeat buyers now average 61 years old. This shift reflects the financial challenges younger generations face and the growing presence of older buyers in the market. Many older buyers are downsizing or purchasing homes with features like single-level living or proximity to family, while younger buyers often delay homeownership until they have greater financial stability. Growth of Multigenerational Living The Real Estate Market Trend of multigenerational living continues to grow, with 17% of buyers purchasing homes designed for multiple generations, the highest percentage recorded. Rising housing costs, combined with the need to care for aging parents or accommodate adult children, are key factors driving this trend. Homes with features like in-law suites, separate entrances, or accessibility accommodations are in high demand. For sellers, marketing multigenerational-friendly properties can attract a broad pool of buyers. Builders are also increasingly designing homes with flexible layouts to meet this growing need. Role of Technology in Home Searches Technology continues to transform the home-buying process, with 96% of buyers using online tools to search for properties. Virtual tours have become a standard feature, allowing buyers to explore homes remotely and narrow their choices before scheduling in-person visits. Mobile apps and listing websites also play a central role in helping buyers compare properties, research neighborhoods, and track market trends. For sellers, the emphasis on technology underscores the importance of online marketing. High-quality photos, detailed descriptions, and engaging virtual tours are essential to attract tech-savvy buyers and stand out in a crowded marketplace. For Buyers: Navigating the Real Estate Market in 2025 Leverage Technology: Use online tools and apps to explore listings, compare prices, and take virtual tours. Research neighborhoods thoroughly before scheduling in-person visits to save time and narrow your focus. Research public city and county websites, local MLS's and neigbhorhood groups for deeper local information on properties, the market. Consider Multigenerational Options: Look for homes with flexible layouts or additional living spaces to accommodate family needs. Pool resources with family members to increase buying power and access larger or more desirable properties. Work with a Real Estate Agent: A knowledgeable agent can help you identify areas and neigbhorhoods and navigate competitive markets, craft strong offers, and identify off-market opportunities. Lean on their expertise to ensure your interests are protected during the search, when writing and negotiationg contracts and closing. Stay Flexible: Broaden your search area to find neighborhoods that are priced lower but still offer most of your "must haves". Consider homes requiring minor updates to expand your options but be wary of fixer uppers as repair costs and contractor availability can be challenging. Be prepared to act quickly in fast-moving markets by securing pre-approval, and when possible, fully underwritten. Reduce contingencies where possible. Be Ready: Great deals can be found in any market. Be ready with your financing in place and a foundation of knowledge about your target market so when the right opportunity hits you can act quickly. For Home Sellers: Maximizing Your 2025 Real Estate Market Opportunities Highlight Multigenerational Features: Emphasize features that appeal to multigenerational buyers - separate entrances, in-law suites, second kitchens or accessibility upgrades. Showcase flexible layouts and shared spaces as key selling points in your marketing materials. Optimize Online Presence: Invest in professional photography, floor plans and engaging virtual tours, and well-written descriptions to attract online buyers. Partner with an agent who understands digital marketing to maximize your listing’s visibility. Price Strategically: Analyze market trends with your agent to set a competitive price that attracts serious offers. Prepare Your Home: Make updates or repairs to enhance move-in-ready appeal. An experienced agent can help you determine which repairs make sense to do and which ones are not worthwhile. They can also help you with a list of vetted contractors. Consider a pre-listing inspection to address potential issues upfront and build buyer confidence. Start early. Often a decision to downsize for example takes years. It will also most likely take time to catch up on maintenance and Conclusion The 2024 NAR report underscores the shifting dynamics of the housing market, shaped by technology, changing demographics, and evolving buyer priorities. Buyers must embrace online tools, consider multigenerational options, and stay flexible to succeed in this competitive landscape. Meanwhile, sellers can maximize opportunities by tailoring their marketing strategies, emphasizing key features, and working with experienced agents to position their properties effectively. Understanding these key real estate market trends for 2025 insights and strategies, both buyers and sellers can navigate the 2025 market with confidence.

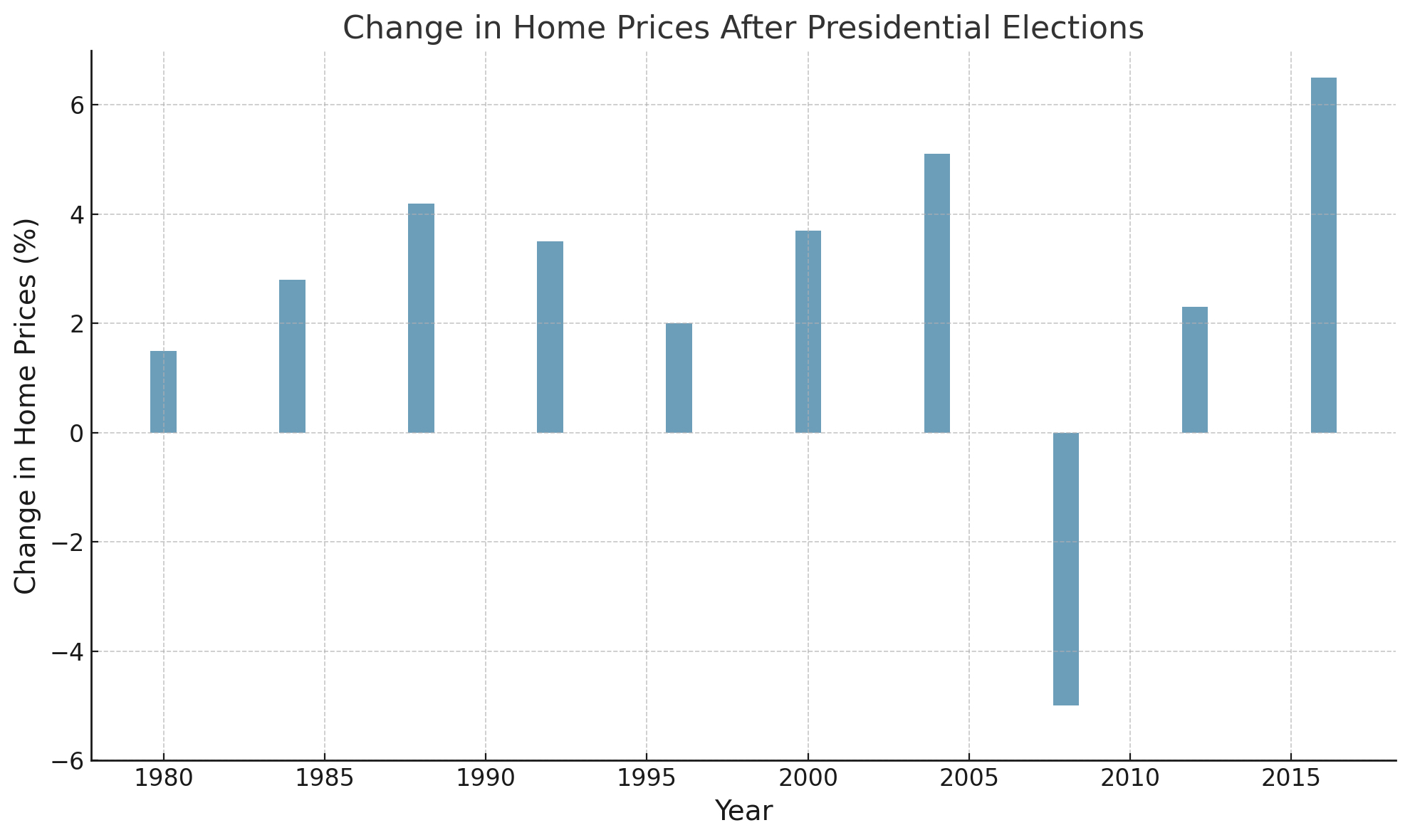

The impact of presidential e...

Read More »

Why Sell Your Luxury...

Read More »

Navigating the Ann Arbor real estate ma...

Read More »

Will the Ann Arbor h...

Read More »

What the experts say you should ex...

Read More »

The Spring Stampede!

What should we...

Read More »

How To Choose An Ann Arbor Realtor

If you goog...

Read More »

The most important considerations in deciding whe...

Read More »

Notifications