A tiny increase on your interest rate can have a huge impact, but don’t buy out of fear! The fear of missing out (FOMO) should not rule your buying decision.

A ¼% increase in interest rates doesn’t seem like a big deal, does it? Actually, it really can be! Think of an average 30 year mortgage plan for a $300,000 home: with a 20% down-payment and a 4% interest rate, you’d be paying $1,145.80 per month, which would amount to $172,486.82 in total interest paid.

Bump up that interest rate to 4.25%, and you’ll be paying $1,180.66 ($34.86 more) per month. While it would probably be easy to find thirty-something extra dollars in your monthly budget to cover the difference, the total interest paid at this rate is a whopping $185,036.07- which is $12,549.25 more!

There are great tools online for calculating your mortgage payments based on loan size and interest rate, such as https://www.mortgagecalculator.org/ .

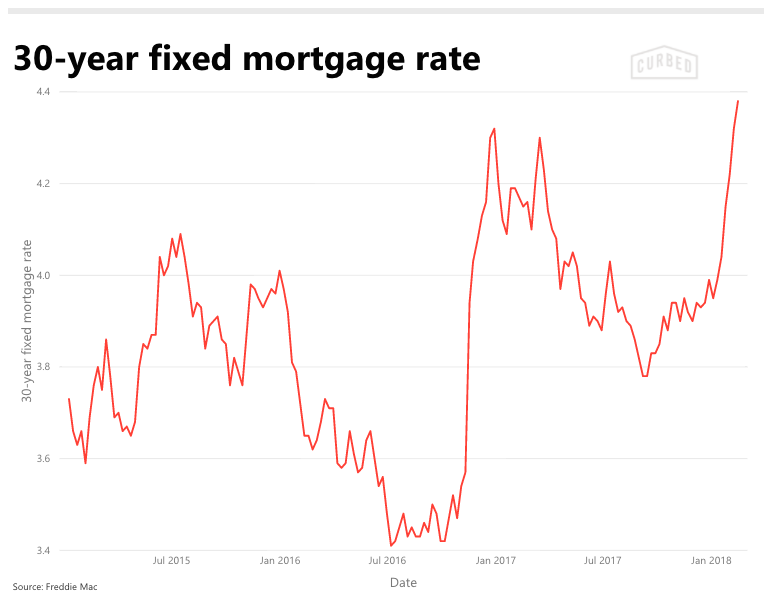

Mortgage rates are rising quickly. Since the Trump election, rates have gone from 3.5% to 4.45 percent – a nearly full 1 percent rise, or 27 percent increase.

Most mortgage rates forecasts predict a steady rise over the next year; on average a 0.85% increase is anticipated. Assuming a 2.6% rise in home pricings as well, “the typical monthly mortgage payment would rise from $804 to $910, a 13.3 percent increase. However, when the projection is adjusted for inflation, it’s still 36.4 percent below the all-time high of $1,263 set in June 2006.” (http://www.freddiemac.com/pmms/)

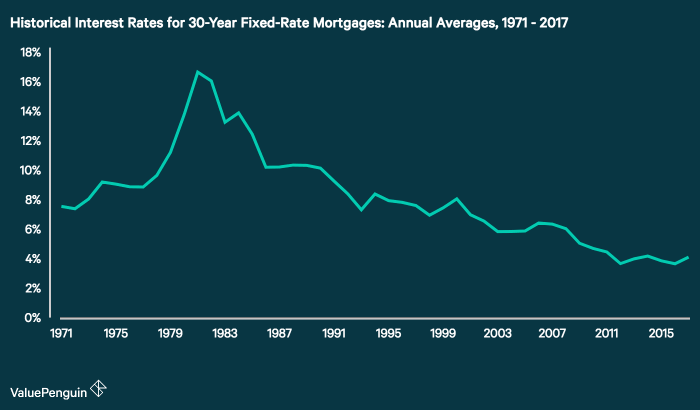

When looking at the longer history of mortgage interest rates, we are still in a comparatively low range of rates.

In recent history, the highest average rate was 16.64% in 1981, and the lowest was 3.65% in 2016. (https://www.valuepenguin.com/mortgages/historical-mortgage-rates#nogo) Now is still a great time to be getting a mortgage, though it certainly is not guaranteed to last.

If you’re thinking of buying a home in the Ann Arbor area, don’t wait around for rates or prices to go down! But – don’t buy out of fear either; buy for the right reasons. If you are in the market to buy a house we can help you make the right choices. Reach out to us today for a free home buying consultation.