What do changes in interest rates mean for buyers and sellers?

Raising interest rates is stressful for both buyers and sellers, but the bottom line is if you want to move, interest rates shouldn’t change your decision. Rather, you’ll have to think through what these interest rates mean for your budget and the kind of home you want. Read on for some tips!

Reevaluate your budget, factor in rising costs

Make sure to include in all housing acquisition and operating costs as well as your daily living costs. It is easy to “blue sky” the total cost of a home purchase and home operating costs. In fact, I often find that many buyers haven’t even considered the rising costs of home repairs and maintenance and rising energy costs into their monthly budget or the costs of daily living and especially the cost of raising children. Take the time up front to understand ALL of the costs of home ownership and how much of your budget is available for housing before shopping for a home. Then, don’t buy at the very top of your budget.

Understand all of your lending and purchasing costs

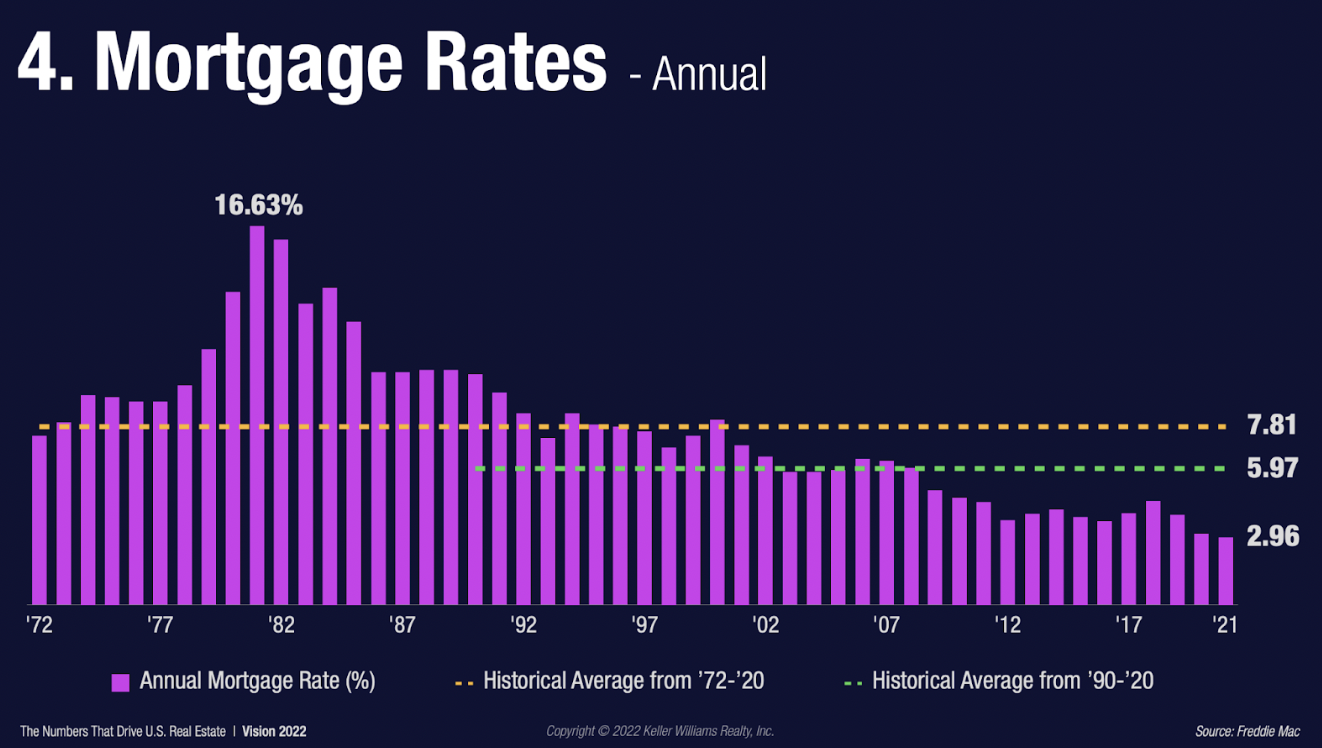

Have your lender explain all of the costs associated with financing your home including all loan origination fees, appraisal and closing costs. If mortgage rates have changed since you were pre approved, have your lender update your pre approval. A one point increase in interest rates on a $300,000 loan will increase your payment by nearly $200 per month. Readjust your purchase price target as needed to stay in budget. This calculator can help you figure out what your payments will look like at various interest rates.

Estimate your taxes based on the assessed value of your your home.

Property tax increases in Michigan are capped. If your home has not sold in many years, there may be a large difference between what the current owner is paying and what you will pay once the taxes reset to the assessed value of your property. Your lender will qualify you based on the current and potentially much lower taxes but in a year, when your taxes reset, they may be much higher. Plan your budget around the new tax amount after it resets at the next tax cycle.

Understand energy costs

Find out the energy costs for the home you are buying by calling DTE or Consumers Energy, they can give you historical data on a homes energy costs. In today’s environment, expect that these expenses will rise and plan accordingly.

Material and labor costs have skyrocketed over the last few years. If you are considering remodeling your new home to fit your needs, that bargain you were considering, may turn out to be much more expensive than you thought once you fully understand the full costs of updating and refitting your home. Add in a factor for overages as projects almost always go over budget. Factor in maintenance costs by planning to set aside 1-2 percent of your homes purchase price per year for maintenance costs.

Most likely, your daily living costs (excluding housing costs) have risen too. Inflation has hit every part of our budgets. Make sure tore-evaluate all of your living costs to understand what how much of your budget is available for housing.

Consider what you need in a home

Can you get the same functionality you need but in a smaller home? Consider the functional spaces you need and ask your realtor to find homes or neighborhoods that offer floorplans that meet your needs but with smaller foot print. A smaller home will likely be cheaper to maintain and operate. A smaller home will be cheaper to outfit and you will save money when outfitting it with furniture, shelving, window treatments etc. An experienced agent can identify areas and neighborhoods with these things in mind giving you more options.

Consider buying a more energy efficient home

Consider an energy rated home that is highly efficient. A home that is 20 years old will likely be at least $100 per month more expensive to heat than a new home due to an increased in energy efficiency in newer construction homes.

Consider commuting costs

Live closer to work to reduce your commuting. If you can work from home there is an opportunity to deeply slash your commuting costs while expanding your location options – Expect that fuel costs will remain high for the foreseeable future.

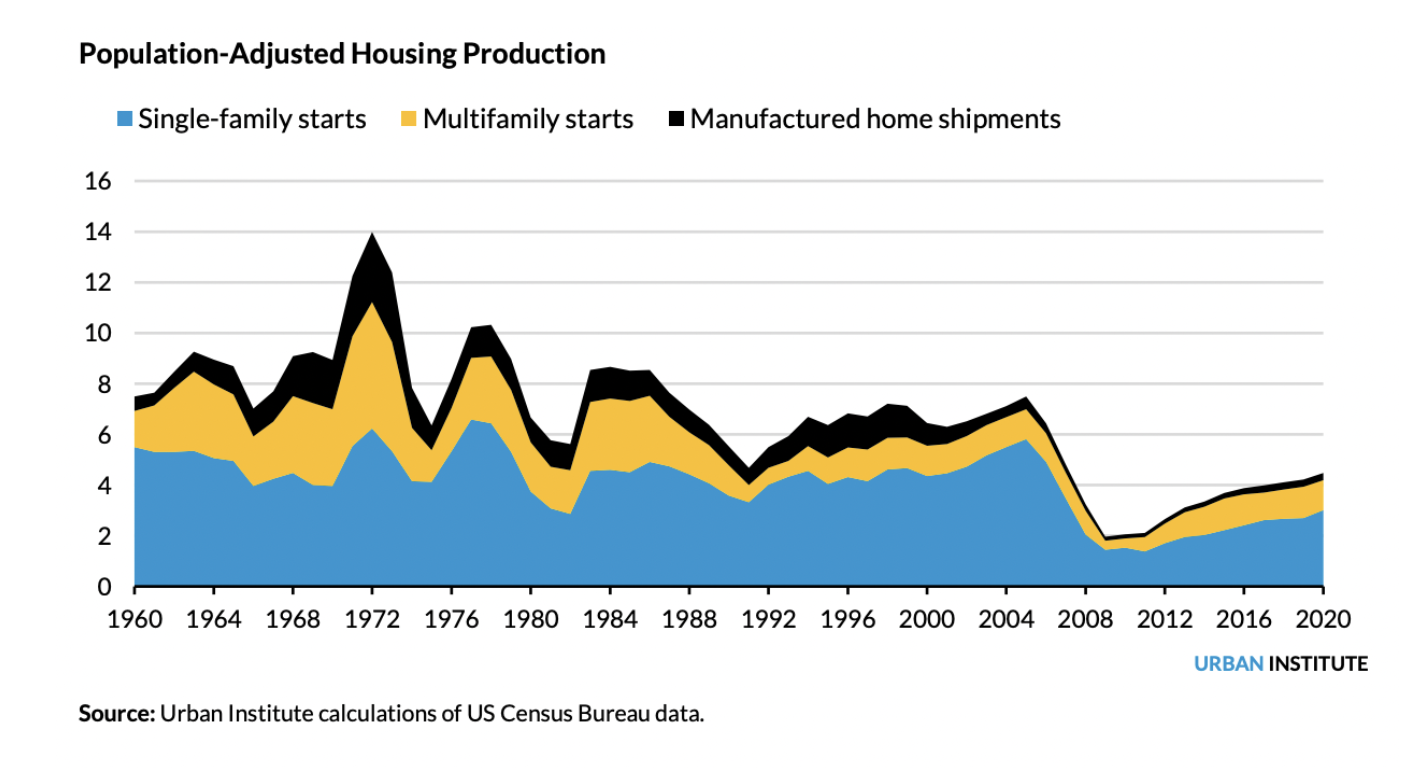

Don’t wait for prices to fall

The Urban Institute, a trusted source for housing information says that higher home costs are likely here to stay due to a shortage of new housing supply. While we are likely to see a leveling out of home price increases, we don’t expect them to fall much. Locking in a mortgage payment now is likely still a great option – if it fits in your budget. You will will likely benefit from asset appreciation due to inflation and lock in a lower interest rate as rates move back to higher historic averages

Sell when the time is right for your particular situation – after considering all the factors.

Time is of the essence. If you have decided to sell, don’t wait. You will likely see more competition, fewer multiple offers and more concessions on inspection items going forward. Prices are at historic highs. Expect price appreciation to settle back closer to the historic average of around 4 percent per year.

Agent Up!

Sell with an agent that can market your home to the full depth of the buyer market available for your home. Selling off market or with an agent that does not property market your home may likely cause you to leave money on the table.

If you own an investment property, it may be a great time to sell

Investors may likely see downward pressure on rents and higher capital gains taxes in the future. This is likely an ideal time to sell unless you are in it for the long haul and like being a landlord.