Navigating the Ann Arbor real estate market in 2024 demands significant motivation and determination from prospective buyers. The current market conditions, characterized by low supply and rising prices, have discouraged many buyers. However, the summer and fall months might offer more favorable opportunities for those who remain committed. This update provides an in-depth look at the market trends, mortgage rates, and key considerations for both buyers and sellers in Ann Arbor.

Ann Arbor Real Estate Market June 2024. Ann Arbor Public Schools areas. Andy Piper, Piperpartners.com

Market Trends

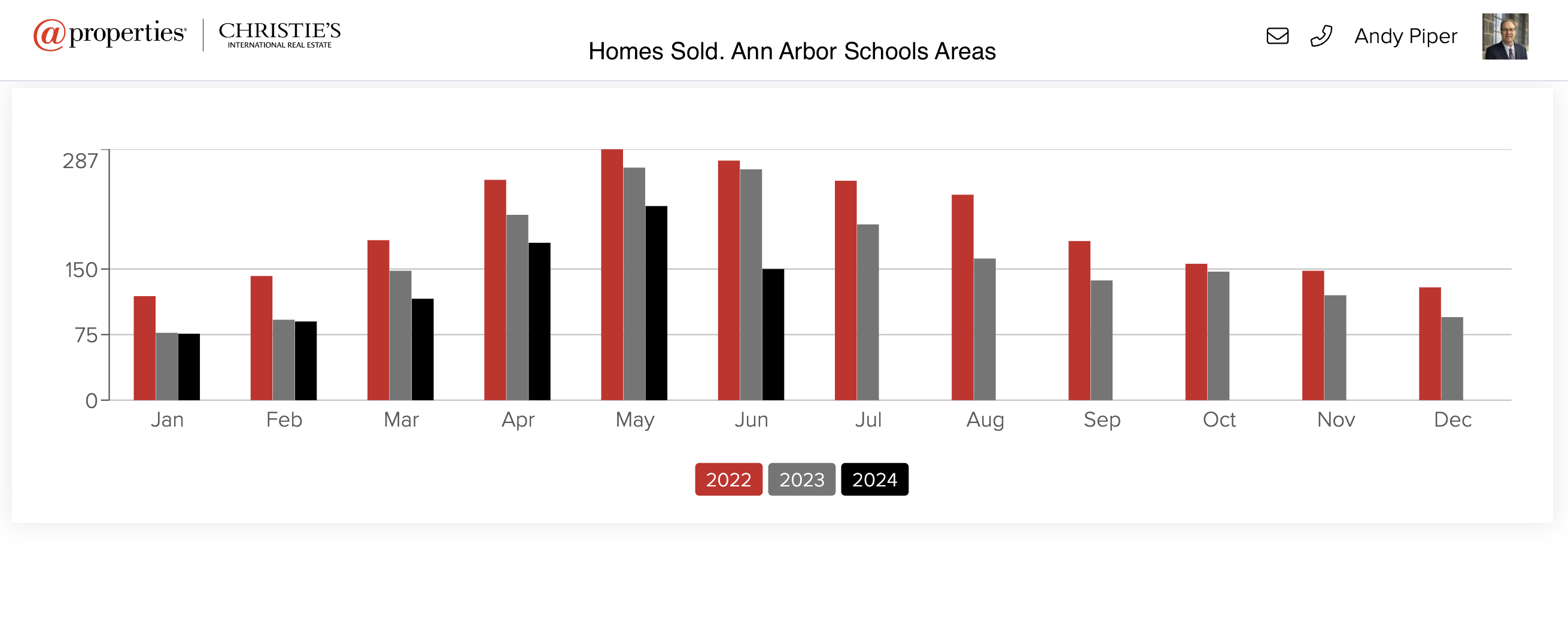

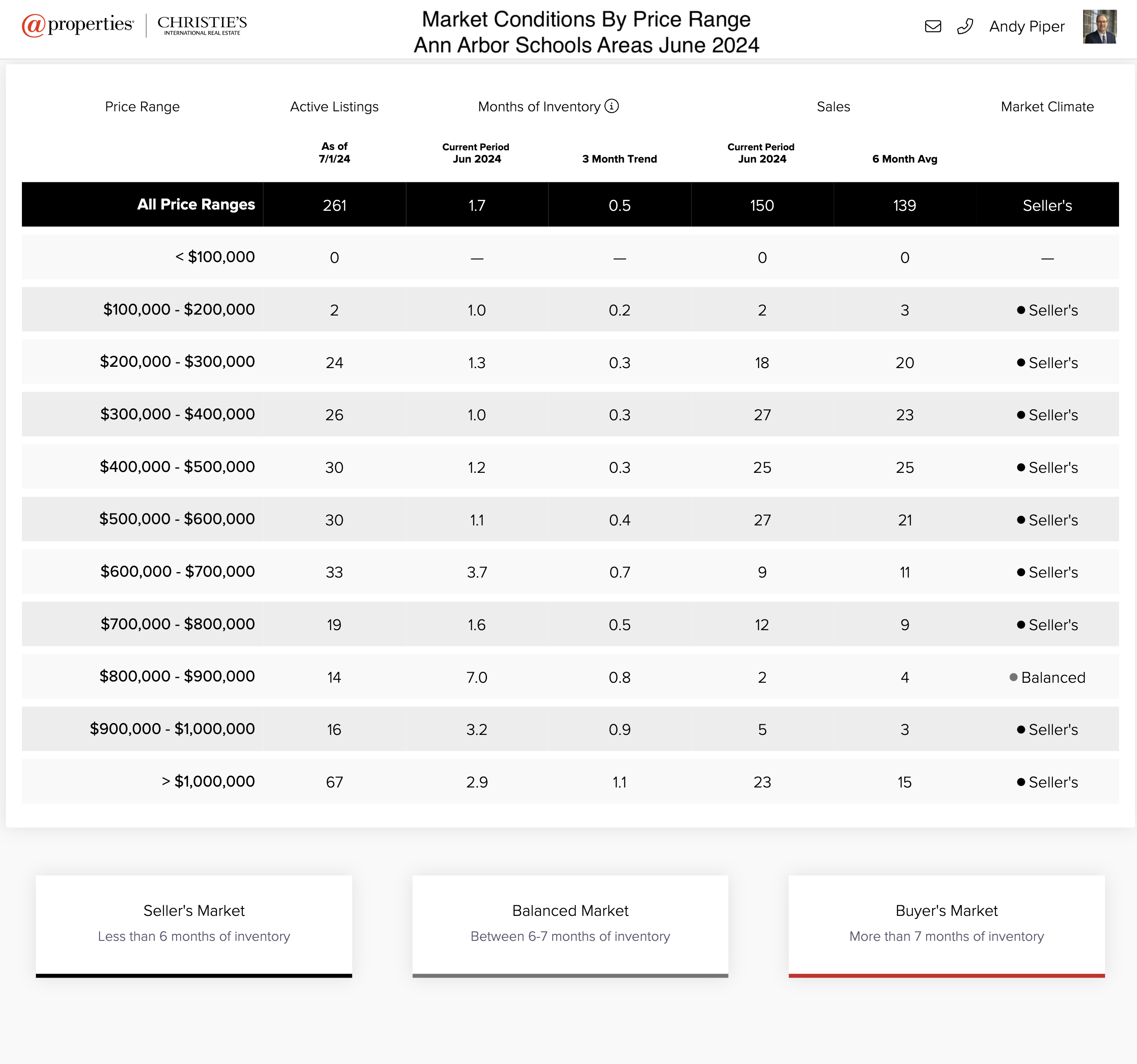

Home sales in the Ann Arbor school areas have seen a noticeable decline, with a 21% decrease year-to-date compared to last year, and a 37% drop in total sales volume. Despite this, home prices have continued to rise due to limited inventory and inflationary pressures. In June, the average home price was 9.1% higher than the previous year.

Considerations for Buyers

For highly motivated buyers (scoring 8-10 on a motivation scale of 1-10), the summer and fall months may present better opportunities. The market is showing signs of increased listings and longer days on the market, expanding from a median of 16 days last year to 21 days this year.

Buyers may find buying in the summer and fall months in Ann Arbor easier. May and June are peak months for home sales in Ann Arbor and buyer activity tapers off in the summer and fall. Buyers should see slightly less competition and good opportunities to buy. Must-move sellers will take markdowns more quickly as they get nervous about meeting their moving deadlines and Michigan winter.

Homes Sold. Ann Arbor Public Schools areas. Andy Piper, Piperpartners.com

Mortgage Rates

Currently, mortgage rates are steady at around 7%, with little change expected in the near future. Experts predict these rates will remain in the high 6% to low 7% range well into 2025. If you can afford the current rates and are ready to buy, it’s advisable not to wait. You can likely refinance when rates decrease, and many lenders offer low-fee refinancing options. Historically, buyers who acted sooner avoided subsequent rate hikes and price increases.

Selling in a Strong Market

Sellers have benefited from the strong market over the past several years, but there are indications that this may be changing. With days on the market and inventory both showing upward trends, the peak of the seller’s market may be behind us. According to Altos Research, there is 38% more inventory nationally this year compared to last year.

Market Conditions By Price Range. Ann Arbor Public Schools areas. Andy Piper, Piperpartners.com

Key Considerations for Sellers

Sellers have locked in strong gains. Homes properly prepared for the market and in excellent condition will likely net the seller a tidy profit within a few months. However, they should be aware of certain challenges:

- Capped Taxes in Michigan: Michigan’s property tax laws cap the taxable value increase of a home at the rate of inflation, which has been lower than the rate of appreciation. Upon selling, the home’s value is uncapped, potentially increasing property taxes significantly on a new purchase, even if the new home is less expensive. For information on Michigan’s “pop-up tax,” see the State of Michigan Tax Payer’s Guide and the Michigan Property Tax Estimator.

- Limited Inventory: Despite increased listings, finding good properties requires high motivation and a reasonable time horizon. See buyer section above.

Tips for Sellers

- Fully prepare your property for the market.

- Not all properties fly off the shelf for top dollar. Those in top condition and fully detailed for the market are likely to sell fast.

- Price your property right.

- It is better to have buyers bidding against each other than to receive 1 low offer or no offers because you overshot the market. If you do price too high, be quick to adjust.

- Consider financing options that allow you to buy before selling.

- Be ready when the right house hits the market. With a low selection of homes available, you may have to wait until the right home hits the market. Talk to a trusted mortgage broker to understand what programs are available.

- Explore new construction.

- A new construction home will give you a pretty firm timeline and time for a good running start to getting your home ready for the market and under contract. Secure occupancy after closing to cover any gaps if your home is delayed.

What the NAR Settlement Means for Home Buyers and Sellers

Starting in August, changes mandated by the National Association of Realtors (NAR) settlement will affect home buyers and sellers. Buyers must sign a written agreement with their agent before touring homes, whether in-person or virtually. You do not need a written agreement if you are just speaking to an agent at an open house or asking them about their services. Agent compensation remains negotiable, and these agreements are not required for open house visits or initial inquiries.

When finding an agent, ask questions about their services, compensation, and written agreements. More details about these changes and what they mean can be found at the National Association of Realtors website.

~~~

The 2024 Ann Arbor real estate market offers both challenges and opportunities. Despite declining sales, prices rise due to limited inventory. Motivated buyers may benefit from increased listings in summer and fall. Sellers should prepare and price their homes competitively to profit.

Stay informed about market trends, mortgage rates, and changes to make the best decisions. For personalized advice, reach out through the contact form below.