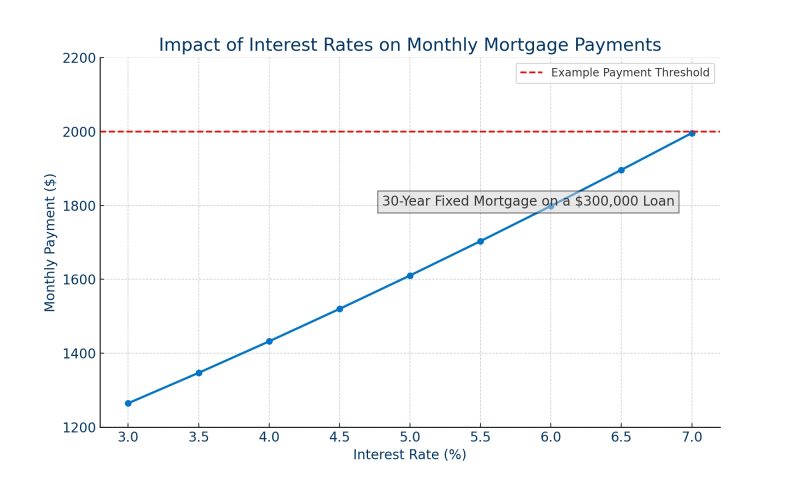

a 1% rise in interest rates would increase your monthly payment by about $188. Over the course of a year, that adds up to an additional $2,258 in mortgage payments.

What the Experts Are Saying About Mortgage Rates in 2025

If you’re planning to buy, sell, or refinance a home in Ann Arbor in 2025, it’s essential to understand how upcoming mortgage rate trends may influence your decisions. While it’s impossible to predict mortgage rates with absolute certainty, leading real estate, finance, and banking experts offer solid guidance on what we might expect in 2025. The consensus? Rates are trending downward, but don’t expect a return to the historically low 3% rates we saw in the past. Most experts forecast that mortgage rates will likely settle in the 5% to 6% range throughout 2025. Here’s a deeper look at what top industry voices are predicting and how these changes might specifically impact the Ann Arbor real estate market.

National Association of Realtors (NAR): Projecting a Gradual Decline in Mortgage Rates in 2025

Lawrence Yun, Chief Economist at NAR, anticipates a steady drop in mortgage rates in 2025 as we move through 2025, driven largely by the Federal Reserve’s efforts to control inflation. Yun expects 30-year fixed mortgage rates to settle around 5.5%. For Ann Arbor, this could make homebuying more accessible, especially for first-time buyers who have been waiting on the sidelines due to higher rates. A drop in rates also means that homeowners might have new opportunities to refinance, reducing their monthly payments.

Read more on NAR’s outlook here.

Rocket Mortgage: Rates Expected in the 5.8% to 6% Range

Rocket Mortgage is predicting that mortgage rates in 2025 will hover between 5.8% and 6% throughout 2025. While this is higher than the pre-pandemic lows, it’s still a drop from the recent peaks in 2023 and 2024. For Ann Arbor buyers, this means slightly better affordability, potentially allowing them to purchase larger homes or explore more desirable neighborhoods. This range also provides opportunities for homeowners to consider refinancing to secure a lower rate than they might have locked in during the past two years.

See Rocket Mortgage’s forecast here.

Chase Bank: Impact of Federal Reserve Decisions

Chase Bank’s analysts emphasize that the Fed’s actions in response to inflation will be a major factor in determining mortgage rates. If the Fed eases its aggressive rate hikes, we could see mortgage rates stabilize in the 5.5% to 6% range. This would provide a more predictable environment for both buyers and sellers in Ann Arbor, allowing for better financial planning when it comes to mortgages.

Learn more from Chase’s projections here.

Redfin: Caution on Persistent Inflation

Redfin’s analysts suggest that if inflation remains stubborn, mortgage rates could stay above 6% longer than expected. While this might slow demand slightly, Ann Arbor’s market is driven by its strong educational and healthcare sectors, which tend to keep demand steady. For buyers, options like adjustable-rate mortgages or rate locks could help secure better financing terms in a higher rate environment.

Read Redfin’s latest insights here.

Zillow: Optimistic for Mid-5% Rates by Late 2025

Zillow projects that rates could gradually decrease to the mid-5% range by the end of 2025. If these forecasts hold, Ann Arbor could see a boost in buyer activity, as more affordable financing could bring new buyers into the market. This could also help maintain home values, which have remained strong in this region due to limited inventory.

Explore Zillow’s forecast here.

Factors Influencing Mortgage Rates in 2025

Several key elements will play a role in shaping mortgage rates next year:

- Federal Reserve Policies: Any adjustments in the Fed’s interest rate policies to control inflation will directly impact mortgage rates. If inflation continues to ease, we could see a stabilization or even a slight decrease in rates.

Economic Indicators: Employment data, consumer spending, and GDP growth will all factor into rate trends. If the economy remains stable, rates are less likely to spike unexpectedly.

Housing Demand in Ann Arbor: The local market dynamics, driven by high demand and limited inventory, could keep property values steady even if rates fluctuate. Ann Arbor’s appeal to both families and professionals ensures a relatively stable demand for housing.

What These Predictions Mean for Ann Arbor’s Real Estate Market

If rates fall into the 5-6% range as most experts predict, here’s how it could affect you: - Buyers: Lower rates mean you could afford a more expensive home or reduce your monthly payments; improving affordability. This could also open up opportunities for first-time buyers who have been priced out of the market due to recent rate hikes and rising prices.

- Sellers: As rates drop, more buyers may enter the market, which can drive competition for properties. If you’re thinking about selling, 2025 could be a favorable time to list, especially in sought-after Ann Arbor neighborhoods.

- Homeowners Looking to Refinance: If you locked in a higher rate over the past couple of years, refinancing could save you significant money each month if rates fall as predicted. Even a small rate reduction can lead to substantial savings over the life of your loan.

Preparing for the 2025 Market

With these expert predictions in mind, planning ahead is key. Whether you’re buying, selling, or refinancing, staying informed about rate trends can help you time your decisions effectively. Working with a local real estate professional who understands the nuances of the Ann Arbor market can give you a strategic advantage.

If you’re ready to explore your options or have questions about how these mortgage trends might impact your plans, reach out today. Let’s make the most of the opportunities the 2025 market will bring!